Where Are All the Houses? Understanding Housing Inventory …

Anyone in the market for a new home can probably tell you options are limited right now. As of mid-April 2022, the number of active listings for homes was down 22% for the year, according to the National Association of Realtors. That’s on top of the housing inventory hitting the lowest level ever recorded last December.

Anyone in the market for a new home can probably tell you options are limited right now. As of mid-April 2022, the number of active listings for homes was down 22% for the year, according to the National Association of Realtors. That’s on top of the housing inventory hitting the lowest level ever recorded last December.

“During the pandemic, people stopped selling their houses,” says Lisa Knee, chair of real estate services for advisory firm EisnerAmper in New York City.

While people now seem ready to put the pandemic behind them, housing inventory levels could take years to rebound. Experts say that’s thanks to factors ranging from the 2008 housing crisis to an influx of millennial homebuyers. The bottom line for buyers and sellers is that the housing market will continue to provide both challenges and opportunities for some time to come.

Fallout From the Housing Crisis

The current low housing inventory has some of its roots in an event that occurred nearly 15 years ago. “There really haven’t been enough homes built since the housing crisis,” Knee says.

After the housing market crashed in 2008, the number of new homes being built plummeted. There were 1.35 million new construction starts in 2007, but that number dropped to just 554,000 in 2009. New construction starts didn’t reach 1 million again until 2014 and have continued to lag below the 1.5 million number that was common in the 1980s and 1990s.

While there were 1.6 million new construction starts in 2021, Knee notes that nearly half a million of those were for apartments or multifamily dwellings rather than single family homes. And now, supply chain issues are causing delays in the completion of these properties.

With a shortage of new homes being built, that has pushed more buyers into the existing home market. However, that is not the only reason for low inventory levels.

Millennial Homebuyers Pushing Demand

A low supply of homes for sale is only half of the housing market’s current inventory woes. The other half is increased demand, particularly from a generation that previously opted out of homeownership.

“We have such a tight inventory because of that millennial group,” says Jeff Taylor, founder and managing director of Mphasis Digital Risk, which provides mortgage services solutions.

Millennials, who are defined as those age 23 to 41, are the largest living generation in the U.S. and have long been inclined to lower levels of homeownership than their predecessors. However, that seems to be changing. More than 4 in 10 homebuyers are now millennials, according to the 2022 Home Buyer and Seller Generational Trends report from NAR.

With the oldest members of Gen Z moving into their mid-20s, demand from first-time buyers for affordable homes could continue to swell and keep housing inventory tight.Remote Workers, Investors Driving Sales in Some Areas

While some people may have kept their homes off the market because of the COVID-19 pandemic, it has led others to relocate. As companies embrace remote work as a permanent option, employees who no longer have to commute are free to consider less costly geographic locations.

A March 2022 report from the freelance marketplace Upwork found 2.4% of people say they have moved since 2020 because of remote work. Another 9.3% – totaling 18.9 million Americans – say they are planning a future move because of remote work.

Many of these workers are leaving large cities, such as San Francisco and New York City, according to Upwork. The cities that are attracting them are often in states with lower tax rates or, for those moving during the height of the pandemic, had fewer living restrictions.

“Areas like Arizona and Nevada are starting to see an influx of people,” says Edward E. Fernandez, president and CEO of 1031 Crowdfunding, an online platform for real estate investors who want to conduct 1031 exchanges to defer the payment of taxes.

In addition to remote workers, many investors are also competing for homes in desirable areas. “Investors are willing to buy property unseen,” Fernandez says in explaining the demand for homes in these regions.

Inventory Rebound Could Be Years Away

With so many factors affecting the market, it’s not likely housing inventory levels will rebound anytime soon. Still, the situation is expected to improve for buyers.

“As interest rates start going up, we should see a slowdown in the real estate market,” Fernandez says. He notes there can be a four- to six-monthlong delay before interest rate hikes make a noticeable difference on sales though.

Rising interest rates should cool demand for new homes, but they won’t affect the supply issues.

“We need to get that supply chain moving,” Knee says. Once more new homes are on the market, the inventory of existing homes for sale could see a boost.

But don’t expect changes any time soon. It’ll be “about four years before we see things level off,” Taylor says.

Considerations for Sellers and Buyers

Current housing inventory numbers mean sellers could get top dollar for their homes. “This is obviously a great time to maximize your value,” Taylor says. On the other hand, unless a seller owns a second home, they will need to buy a new house.

“(Someone) who is selling high is also buying high,” Fernandez notes.

Sellers should do their homework before putting their property on the market. If buying a new home is unaffordable, it may be better to stay put. For anyone worried they will miss out on selling for top dollar, Taylor doesn’t believe housing prices will drop.

“I think price appreciation will level off, but I think house values are extremely sound,” he says.

For buyers, the good news is that the days of double-digit percentage price increases may be coming to end. The bad news is that there still may be limited housing choices on the market, and rising interest rates will make homeownership more expensive.

“The answer might be in the rental market,” Knee says. While rental prices are up and vacancies are down in some areas, it might be a more affordable option for those who feel priced out of homeownership.

Thank you to www.realestate.usnews.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

Mortgages and house prices in the US: which is better in 2022, buying or renting, according to experts?

The pandemic has brought about some very unique economic circumstances which could have huge ramifications for people considering moving house this year. The economic recovery has triggered a spell of high inflation which is hurting consumers’ buying power.

The pandemic has brought about some very unique economic circumstances which could have huge ramifications for people considering moving house this year. The economic recovery has triggered a spell of high inflation which is hurting consumers’ buying power.

The United States’ housing market is currently in a state of flux, with house prices sky-rocketing, high interest rates and rental prices on the rise too.

The S&P CoreLogic Case-Shiller Index found that by January 2022 home prices had jumped by 19.2% year-on-year, while the average cost of a single-family rental property had also increased by 12.6%. Now is an expensive time for housing, whether you are renting or buying, so experts are advising people to think what is actually required to satisfy their personal requirements.

Lexie Holbert, housing and lifestyle expert for Realtor.com, recommends: “If you’re not sure whether or not you want to rent or buy right now … it’s better to make your decision based on your personal situation and your personal needs.”

Timing is key when considering whether to buy or rent

The pandemic recovery has sent the cost of everything from groceries to gasoline soaring and consumers are unlikely to find any real bargains until the markets begin to level out. However we don’t know how long that is likely to take and housing is often a very time-sensitive decision.

The key difference between mortgage and rental agreements is the duration, with rental contracts better suited for short-term moves. Holbert advises that buying a property does work out as cheaper in the long run, but that it can take between five and seven years for a homebuyer to recoup the purchase costs.

“If your home needs are going to be pretty consistent and pretty stable over the next few years, now may be a really good time to buy for you,” Holbert said.

“If they’re changing, you may want to consider renting so that you have the flexibility to move.”

However if you feel like this could be the right time to get on the housing ladder and you are willing to wait, there could be better value on the horizon. Mortgage rates are expected to remain high, likely above 4%, for much of the year, which could squeeze some prospective buyers out of the market.

Holden Lewis, home and mortgage expert at Nerdwallet, believes mortgage rates could be above 4.5% towards the end of the year. With this in mind, there could be less competition for homeowners.

Lewis says: “The combination of rising interest rates and rising house prices will push some would-be buyers out of the market, which may result in reduced competition after the summer buying season is over.”

Thank you to en.as.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

Where—and how—Atlantans want to live now

Welcome to the Age of Nesting. The London-based Future Laboratory coined that phrase, noting that we’ve just emerged from “the largest home-working case study in history,” which will profoundly impact where and how we live. The Economist reported that moving patterns could be in for the greatest shift since the suburbanization of the 1950s.

Welcome to the Age of Nesting. The London-based Future Laboratory coined that phrase, noting that we’ve just emerged from “the largest home-working case study in history,” which will profoundly impact where and how we live. The Economist reported that moving patterns could be in for the greatest shift since the suburbanization of the 1950s.

Nowhere are people giving this more thought than here in Atlanta, a city that offers an especially wide array of living choices. It’s one reason our metro area has grown so rapidly—behind only Dallas and Houston in the last decade. But the plethora of options makes tracking significant shifts complicated. Harry Norman’s Todd Emerson told Axios Atlanta that, in 2021, the two metro neighborhoods with the highest home value appreciation were Kirkwood and Norcross. People are moving both in and out of the city. Apartment List Chief Economist Igor Popov suggests our nation isn’t so much experiencing an urban exodus as an “urban shuffle.”

Not only are we considering different places to live, we’re looking for different types of living spaces. Before the pandemic, “we were really on a downward trajectory, with people trying to build smaller, more efficient homes and well-appointed homes,” says Nicholas Brown, an agent with Compass real estate in Atlanta. “Now, I’m starting to see square footage sizes move back up again. People are willing to spend more than I’ve ever seen before to get exactly what they want.”

Outdoor entertaining areas have become a priority at all price points, whether that’s a wide front porch or a basketball court. “And you cannot even get an appointment with a pool contractor,” Brown adds. He’s finding buyers want to walk directly outside from the main floor, so daylight basements have become less desirable.

Brown says families are demanding one or even two home offices, not to mention homework rooms for the kids—all outfitted with plenty of charging stations and wireless technology. People are adding security systems and outdoor reception areas to keep deliveries hidden, sometimes even equipped with refrigeration for perishable Instacart deliveries. Because people are spending more time at home, they now prefer laundry rooms on the main floor. Brown had one client devote a closet entirely to paper products.

Thank you to www.atlantamagazine.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

New-home sales fall again in March

U.S. new-home sales fell again in March as low inventory, rising interest rates and elevated home prices curbed the pace of transactions.

U.S. new-home sales fell again in March as low inventory, rising interest rates and elevated home prices curbed the pace of transactions.

The rate of new single-family home sales fell 8.6% from January’s revised number to a seasonally adjusted, annual rate of 763,000, while the median sales price jumped to $436,700 from February’s revised median house price of $421,600, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

On a year-over-year basis, the pace of new-home sales in March was down 12.6%.

The seasonally adjusted estimate of new homes for sale at the end of March was 407,000, representing a supply of 6.4 months at the current sales rate, according to a press release.

While rising mortgage rates and home prices have crimped homebuyer purchasing power, the housing market still stands to benefit from other factors at work, RCLCO Real Estate Consulting principal Kelly Mangold said.

“Demographics remain a strong driver of housing demand, and as the market adjusts to deliver product at price points and formats that align with this demand, sales are likely to be bolstered,” she said. “In particular, due to the shortage of construction labor, buyers may be more hesitant to purchase a fixer-upper, understanding that the cost and timeline of renovations may be extended, making a turn-key new construction home more appealing.”

By region, the number of new-construction homes sold was down across the board, led by the South with a 10.2% monthly drop and followed by the Midwest with an 8.7% drop, the West with a 6% decline and the Northeast with a 5.4% decrease.

Thank you to atlantaagentmagazine.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

Record High Office Vacancies on the Horizon

A new report shows that we should expect 243 million square feet of U.S. office space to hit the market soon. A slew of U.S. office leases are set to expire thanks to the fact that many office tenants whose leases were set to end during the worst of the pandemic signed one-year or two-year renewals as they tried to figure out how much less space they would need under a hybrid strategy.

These expiring leases account for around 11 percent of all leased office space in the United States, according to data from JLL. If these spaces are not renewed or released it could result in a disastrous domino-effect of lost revenue and lower property values. Many expect a dip in office space demand, 15 percent by some estimates, can be attributed to the post-pandemic reality of a remote or partially remote workforce.

Loans to office building owners who are in default are also on the rise. According to a Barclays analysis, 21.2 percent of office loans packaged into commercial mortgage securities during the global financial crisis were either handled by special servicers or on watch lists in February, two closely watched categories that could lead to defaults. Since 2010, this is the highest level.

It’s the perfect storm of rising interest rates, lowered occupancy with remote or a partially remote workforce, and loans coming due that’s resulting in giving office landlords and economists grief. But despite the looming gap of office leasing ahead, big tech companies (like Meta, Google, and Microsoft) have been expanding their office footprint. That said, most office tenants aren’t expected to increase their leasing activity any time soon, so we will have to wait and see just how much of an economic threat this will be.

Thank you to Propmodo for this article. To read more, click here!

For Additional Blog Content, Click Here!

Waiting on the Housing Market to Crash? Don’t, Experts Say. Here’s How Today’s Market Is Different From the Great Recession Housing Bubble

Home prices are higher than they’ve ever been, and they show no signs of stopping.

Home prices are higher than they’ve ever been, and they show no signs of stopping.

The median U.S. home listing price was $405,000 in March 2022, the first time it’s broken the $400,000 price threshold, according to data from Realtor.com. That is an increase of 26.5% over two years.

Homebuyers might see similarities between what’s happening today and the 2006 housing market where home prices became increasingly unaffordable until the bubble burst, helping trigger the worldwide financial crisis we came to call the Great Recession.

Stressed-out buyers might be thinking these high prices are a bubble just waiting to pop again. In fact, 77% of homebuyers believe there’s a bubble where they live, according to a recent Redfin survey.

Today’s market differs significantly from what happened 15 years ago, when high home prices were instead driven by loose lending practices and rampant investor speculation in the market.

Waiting for the market to crash might not yield the results buyers hope for, experts say. “There’s not really any room for there to be a bubble right now. It’s not like people have borrowed too much and it’s not like homes are overvalued,” says Daryl Fairweather, chief economist at Redfin.

There are a lot of reasons why it seems like we are in a bubble, but at its heart, the issue is simple: supply and demand are driving up prices. “It’s just that there aren’t enough homes for everybody who wants one,” says Fairweather.

Here’s what is different about today’s market, what’s behind the record-high prices, and what buyers can do to navigate the process.

Things Have Changed Since 2006

The current market and that of the mid-2000s share some similarities. Namely, housing prices were up and often unaffordable for buyers. The causes are different, experts say.

The previous bubble came after a period in which lenders were more lax about writing loans and more people were in the housing market as an investment rather than to buy a home to live in. “Mortgage underwriting was considerably more loose back in 2006,” says Robert Dietz, chief economist at the National Association of Home Builders. “It was easier to get a mortgage to speculate in the housing market. That is not the case today.”

Different home loans, such as adjustable-rate mortgages with big “balloon payments” due at the end of the term, meant people got into homes thinking they could afford the payments, finding out later that their payments grew dramatically to unaffordable levels, Fairweather says. “There was a lot of financial engineering, there was a lot of predatory lending, there was a lot of bad borrowing on people not having a lot of equity, not having as much of a cushion, that led to the housing bubble,” she said.

Those types of loans are far less common today, and there is more oversight of home lending in the wake of the crisis of the late 2000s, experts say. Today, most borrowers get 30-year fixed-rate mortgages, which don’t come with the risk of payments suddenly rising dramatically as rates increase, Fairweather says. “If you own a home, you’re still paying what you paid when you got your fixed-rate mortgage.”

There Aren’t Enough Homes

There are two major ways homes enter the market: Somebody builds a new one or somebody sells an old one. Both of those pipelines are a bit out of whack. “Today it’s really just about lack of supply,” Dietz says.

Builders Are Struggling to Catch Up

The limited supply of new homes is due to factors both old and new, Dietz says. For the last decade, builders haven’t put up houses at the rate they needed to in order to handle today’s demand, which he says has probably created a deficit of at least a million homes. At the same time, costs have gone up since the pandemic. Deitz blames the constraints in the market to what he calls the “five Ls”:

Labor: Builders are having a hard time finding skilled workers, particularly in hot markets such as Texas.

Lots: There’s about a year’s supply of lots available, when the market needs two to three years.

Lending: Homebuilders, especially the smaller companies, face a tighter market for borrowing the money needed to build.

Lumber and building materials: Lumber prices were about $350 per thousand board feet in January 2020. That’s about $1,300 now, Dietz says. On top of lumber, there are shortages and delays in things like garage doors and microwaves.

Laws and regulations: Issues like zoning can limit how many homes can be built in a certain amount of space.

The tight housing market means new construction is even more important for buyers trying to get a home. While new homes typically account for less than one in 10 sales, that figure is now about one in three, Deitz says. Supply chain issues also mean new homes take longer to build – from a typical time of about six and a half months to now about eight months.

“When you add all those together, it’s just gotten a lot harder to build homes,” he says.

Fewer People Are Selling

Existing homes make up most of the market, but the supply of those is down also. Some of that has to do with the affordability issues affecting buyers. A survey by Discover Home Loans found 79% of homeowners would rather renovate their homes than move.

High home prices might seem to encourage people to sell their homes and cash in, but most of those people would have to buy another home, and pay those high costs. “If they try to buy again, they’ll be facing a really tough market as a buyer,” Fairweather says. “The only people who are really in a good position to sell and buy again are people who are downsizing or moving to a more affordable area.”

There Are More Buyers

The supply constraints mean there aren’t as many homes for people to compete for, but those open houses are also busier than ever. That’s because more people are deciding homeownership is right for them at the moment.

“There’s a lot of demand for homes right now,” Fairweather says. “A lot of people are looking.”

Part of that is that millennials are entering their prime homebuying years, experts said. Many members of this big generation are in their 30s, often married with children. “We are seeing a big push from millennials to buy a home,” Fairweather says. “That has been years in the making.”

The pandemic has also made remote and hybrid work a possibility for many. That means you don’t have to live close to an office and you might need more space than you can find in an apartment. Remote work means owning a home is a possibility for more people, Fairweather says, adding to demand.

When Will the Housing Market Calm Down?

It will likely take a while before the inventory of available homes matches up with demand. Experts surveyed by Zillow predicted it’ll be two years before monthly inventory returns to pre-pandemic norms. They estimated it could be 2024 or 2025 before the portion of first-time buyers again reaches the 45% seen in 2019.

Rising mortgage rates – they’ve gone from near 3.3% at the start of the year to near 5% in just three months – will likely take some buyers out of the market and slow the rise of home prices. “It should weaken demand, but there’s so much demand it’s hard to say how much it will really impact things like sales and home prices,” Fairweather says.

Higher mortgage rates might not directly lead to lower prices – supply and demand will still be the big factors – but it could make life a little bit easier for buyers, Dietz says. “The bidding wars are going to cool off.”

The factors driving up prices aren’t likely to subside anytime soon, Dietz says. “I don’t think buyers should be betting on any really significant price declines. If anything, as interest rates move higher, the cost of buying a home is going to go up.”

What Can Homebuyers Do In This Market

As Redfin’s survey found, many buyers think the market is in a bubble right now, and they might be tempted to wait for it to burst, some economic cataclysm that suddenly makes a house affordable. Experts caution against hoping for that.

“I think you want to be strategic and you want to be patient,” Dietz says. “Patient is different from waiting for a crash.”

Buyers will have to look harder and widen their search, he says. There are ways to get creative: If your work is hybrid and you only have to go to an office two or three times a week, reconsider your commute and think about it on a weekly basis rather than as a daily burden. That means you could look farther away from work where housing is sometimes cheaper.

You can also consider other options, Dietz says. One is to look at new construction if you haven’t already. Keep in mind there is a longer lag time than usual, but it could be easier than competing for scarce existing homes with the mob of other potential buyers (and investors and flippers with cash offers). There are also options other than the usual single-family home, such as townhouses.

Any slowdown caused by higher mortgage rates will make the market a little easier for buyers who are patient, Fairweather says. “By end of summer there should be more homes on the market as not as many buyers will be taking them off the market,” she says.

The market could be in for a shift this year as it copes with higher mortgage rates, Fairweather says. You may want to slow down and consider your options. “I don’t think it’s wise to try to rush the market now because right now the market is adjusting,” she says.

Thank you to time.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

How a Surge in Interest Rates May Actually Benefit You

With the national inflation rate climbing faster than we have seen in over 50 years, the Federal Reserve recently made efforts to curb the upward pace by raising interest rates for the first time in over 2 years. Where this is designed as a positive move to help inflation woes within the next year, it has immediately impacted those who wish to borrow money, namely prospective homebuyers, in a very negative way.

According to Freddie Mac, the rise in mortgage rates is the fastest three-month increase in over 20 years.

Interest rates rose from 2.67 percent to 5.08 percent in recent weeks. What this means essentially is the median average price of a home in the US has risen from $309,200 to $357,300 in just 14 months.

For homebuyers this nearly doubling of interest rates will make their monthly payments significantly higher. So should you wait to buy??

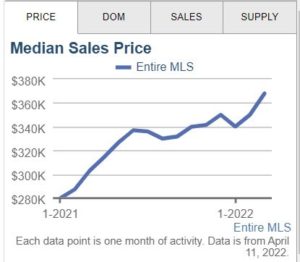

Taking a look at the real estate market in and around the Atlanta area over the past year according to FMLS (the primary database used by Realtors), median prices have risen from $280,000 in January 2021 to $368,000 in late March 2022.

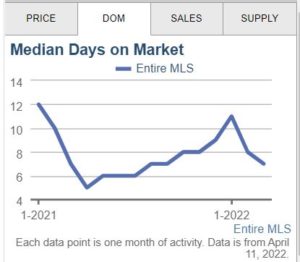

Average days on market from January 2021 until late March 2022 went from 12 to 7.

Sales as reported to FMLS from the same periods went from 6,659 to 9,272.

Looking at this data, there has actually been a pretty significant increase in sales volume as more homes have been slowly coming on the market and new builds are starting to pop up here and there. Prices are expected to still rise, but with higher interest rates, mortgage applications have plummeted therefore there will be much less competition. This will theoretically keep home prices from skyrocketing into bubble territory and also dramatically extinguish the brutal bidding wars of the past, elevating your offer to the top because your rivalry just left the field.

And as someone who has held a real estate license for over 20 years, and whose mother and grandmother were also licensed Realtors, 5% is STILL an incredibly low interest rate for a

mortgage.

The answer to the question I posed above is yours alone to make, but hopefully you now have some beneficial information to assist you in the process.

By Holly A. Morris, Realtor

The Meridian Real Estate Group

For Additional Blog Content, Click Here!

Converting a Bedroom into a Home Office

In today’s world, we all need a place to be able to work from home. Whether for the professional that gets away to Atlanta from another area or has decided to make this their main home. As the featured decorator for the home office at the 2022 Kips Bay Palm Beach Showhouse, Tish Mills offers her ideas in transforming a bedroom, or unused space into a home office.

In today’s world, we all need a place to be able to work from home. Whether for the professional that gets away to Atlanta from another area or has decided to make this their main home. As the featured decorator for the home office at the 2022 Kips Bay Palm Beach Showhouse, Tish Mills offers her ideas in transforming a bedroom, or unused space into a home office.

What is a good point of reference when setting out to create your workspace?

Keep in mind that the boundaries of work and home have never been more blurred. It’s necessary to find refuge by creating an office where you can work from home and find that corner of your inner world to connect to the outer world. A home office is a place that is highly personal and just as much of a reflection of who you are as the other main living areas of your home. So, the emphasis needs to be on who you are, what makes you happy to look at, and of course, what’s that perfect Zoom background. Beyond that, great lighting!

What IS great lighting for an office?

I like to use a mix of natural light, ambient and task light almost like a kitchen or other work areas in the home.

Other than a good desk and chair, what are some other things to keep in mind?

You want to make sure that you have a good lounge area in your office. It can serve as the perfect spot to curl up or take that important call. I’d suggest a nice settee in a comfortable and inviting fabric that will lure you to it as it should serve as a great spot to read that important document away from the distractions of a computer on the desk.

How important is art in an office?

Art is always important. It can elevate the space very easily. I like art in a home office that is inspiring and carries you into the story of the room. I personally find that I stare at my own artwork when I am searching for an answer or thinking through an issue that needs creative input. So, something inspirational or aspirational is important.

How to pick out the right palette to work with?

You want your office to be an inspirational workspace where you can create and relax. For example, in my Kips Bay Palm Beach Showhouse bedroom, I chose to work with a meditative palette of sand, surf and sunsets in soft whites, beiges, blues and a touch of lavender. Think of colors that you want to surround yourself with and how they make you feel. The purpose is to elevate the space for yourself. This is your room where you’ll be spending a good deal of your time so it should be a good reflection of you and what you like to surround yourself with.

How to work around difficult areas like the closets?

If you don’t think you’ll be using the closet, you can repurpose it into another space. I took the closet from the former bedroom in the Showhouse and transformed it into a chic fireplace which helped create the comfortable, cozy mood perfect for contemplating, reading and relaxing. Think of what is missing in your office to make it your own special nook!

Tish Mills Kirk of Tish Mills Interiors, a preferred vendor of The Meridian Real Estate Group, is an award-winning interior designer who has been working with clients in their homes for more than two decades. She believes that it is essential to put together a cohesive plan for your home renovation before you get started that can be carried out by the team of experts you assemble. www.harmoniousliving.net

For Additional Blog Content, Click Here!

For more info, contact:

Beth Dempsey – Images & Details, Inc.

203.962.3235

[email protected]

Photos provided by Chris Little.

Instant Reaction: Mortgage Rates, March 24, 2022

Mortgage rates continued their upward trek. Specifically, the 30-year fixed mortgage rate surged to 4.42% from 4.16% the previous week. Elevated inflation and the Federal Reserve’s tightening policy pushed up mortgage rates. Since the beginning of the year, rates have already increased by 1.2%. As a result, the typical home buyer needs to spend $250 more every month to be able to purchase a home.

Mortgage rates continued their upward trek. Specifically, the 30-year fixed mortgage rate surged to 4.42% from 4.16% the previous week. Elevated inflation and the Federal Reserve’s tightening policy pushed up mortgage rates. Since the beginning of the year, rates have already increased by 1.2%. As a result, the typical home buyer needs to spend $250 more every month to be able to purchase a home.

Impact of higher rates on home sales

Both new and existing-home sales dropped in February. Existing-home sales fell by 7.2% and new home sales declined by 2.0% compared to January. These headline figures are the seasonally adjusted figures that are reported to the news. However, this was not the actual number of sales but the number of sales after adjusting for seasonality. For everyday practitioners, simple raw counts of home sales are often more meaningful than the seasonally adjusted figures as the raw count helps better assess how busy the market has been. According to the raw count of sales, both existing- and new-home sales improved compared to January. Existing- and new-home sales rose by 1.4% and 1.6%, respectively. Compared to pre-pandemic, home sales in February outperformed. For example, in February 2018, when mortgage rates were also rising, about 320,000 existing homes were sold. By comparison, nearly 360,000 existing homes were sold last month. Although rising mortgage rates increase borrowing costs, making housing less affordable, about 40% of the millennial renters who approach family life can still afford to buy the typical starter home.

Thank you to www.nar.realtor for the Article. For More, Click Here!

For Additional Blog Content, Click Here!

Even Google Agrees There’s No Going Back to the Old Office Life

The great enforced global experiment in working from home is coming to an end, as vaccines, the Omicron variant and new therapeutic drugs bring the COVID-19 crisis under control.

The great enforced global experiment in working from home is coming to an end, as vaccines, the Omicron variant and new therapeutic drugs bring the COVID-19 crisis under control.

But a voluntary experiment has begun, as organisations navigate the new landscape of hybrid work, combining the best elements of remote work with time in the office.

Yes, there is some push for a “return to normal” and getting workers back into offices. But ideas such as food vouchers and parking discounts are mostly being proposed by city councils and CBD businesses keen to get their old customers back.

A wide range of surveys over the past 18 months show most employees and increasingly employers have no desire to return to commuting five days a week.

The seismic shift in employer attitudes is signalled by Google, long a fierce opponent of working from home.

Last week the company told employees they must return to the office from early April – but only for three days a week.

That’s still way more than tech companies such as Australia’s Atlassian, which expects workers to come into the office just four days a year, but it is a far cry from its pre-pandemic resistance to remote work.

Hybrid work is here to stay. Employers will either embrace the change or find themselves being left behind.

Gains in productivity

Google began – under pressure – to soften its opposition to remote work in 2020. In December of that year chief executive Sundar Pichai told employees:

We are testing a hypothesis that a flexible work model will lead to greater productivity, collaboration, and well-being.

Google’s corporate headquarters in Mountain View, northern California. It has softened its historical opposition to remote working by insisting workers must return to the office for three days a week.

Google’s corporate headquarters in Mountain View, northern California. It has softened its historical opposition to remote working by insisting workers must return to the office for three days a week.

Its chief concern has been protecting the social capital that springs from physical proximity – and also perhaps with keeping employers under surveillance.

But longstanding (and widespread) management concerns that employees working from home would lower productivity have proven unfounded.

Even before the pandemic there was good research showing no productivity penalty from remote working – the opposite, in fact.

For example, a 2014 randomised trial involving about 250 Shanghai call centre workers found working from home associated with 13% more productivity. This comprised a 9% gain from working more minutes per shift – due perhaps to fewer interruptions – and a 4% gain from making more calls per minute – attributed to a quieter, more comfortable working environment.

Research in the past two years supports these findings.

Harvard Business School professor Raj Choudury and colleagues published research in October 2020 that found allowing employees to work wherever they like led to a 4.4% increase in output.

In April 2021, Stanford University economist Nick Bloom and colleagues calculated a the shift to remote working resulted in a 5% productivity boost. Though their working paper, published by the National Bureau of Economic Research, was not peer reviewed, it was based on surveying 30,000 American workers, which is a decent sample size.

Our relationship with work has changed

There are good reasons most of us don’t want to go back to the old normal. It just wasn’t that great.

While working from home can brings challenges of other kinds, not least the ability to switch off and stop working when work is done, working in an office can increase stress, lower mood and reduce productivity.

My own research has measured the effects of typical open-plan office noises, finding a 25% increase in negative mood even after a short exposure time.

Then there’s the time spent commuting. Not having to go into the office every day frees up hours of time to do other things. Particularly in winter it’s nice to not have to leave and arrive home in the dark.

Preferred number of days working at home, by occupation

Results from a survey of Australian workplaces during 2020 lockdowns. Institute of Transport and Logistic Studies, University of Sydney, CC BY

Changed expectations of work

The importance of these things should not be underestimated.

In a June 2021 study by McKinsey of 245 employees who had returned to the office, one-third said they felt their mental health had been harmed.

The experience of the pandemic has lowered our tolerance for this old world of work.

Nothing exemplifies this better than the growth of the “lie-flat” trend, which began in China and is now a global phenomenon. Increasing numbers of people are rejecting the idea of pursuing a career at all costs.

They don’t want to spend their life being a cog in the wheel of capitalism and are choosing to work less – even not at all.

No one size fits all

Rather than a bastion of meaning and fulfilment, the structures around how we have conducted work has for many people meant an existence of quiet desperation. The pandemic has brought an unforeseen opportunity to change this narrative and rethink both the way we work and the role of work in our lives

For some, no job is better than a bad job. The rest of us will settle for the flexibility we’ve had over the past two years.

No one size fits all. The downsides of working from home include missing coworkers and losing the benefits of serendipitous conversations. The nuances of how much time we need to spend together in the office for outcomes like creativity, belonging, learning and relationship building varies between individuals, teams and job types.

But what is certain is we don’t need to be together five days a week to make these things happen. With a shrinking workforce and an increasing war for talent, employers who don’t provide flexibility will be the losers.![]()

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Thank you to Propmodo for this article. To read more, click here!

For Additional Blog Content, Click Here!

What’s the Best Way to Reposition an Empty Shopping Mall?

The image of a shuttered ghost town that many of America’s shopping malls have become is much different than the bustling epicenters of economic and social activity that they once represented. “The mall, in its heyday, was a portal to the lifestyles to which people could aspire,” writes Misty White Sedell of the Los Angeles Times, “a stomping ground for discovery.” Pandemic lockdowns were a devastating blow to brick-and-mortar retail, but the American mall was losing to e-commerce well before then. Now, many malls are an economic deadweight, and the question of what to do with them continues to puzzle investors and landlords. If shopping malls will never again return to their place as our consumeristic hubs, how can they be put to better use?

The image of a shuttered ghost town that many of America’s shopping malls have become is much different than the bustling epicenters of economic and social activity that they once represented. “The mall, in its heyday, was a portal to the lifestyles to which people could aspire,” writes Misty White Sedell of the Los Angeles Times, “a stomping ground for discovery.” Pandemic lockdowns were a devastating blow to brick-and-mortar retail, but the American mall was losing to e-commerce well before then. Now, many malls are an economic deadweight, and the question of what to do with them continues to puzzle investors and landlords. If shopping malls will never again return to their place as our consumeristic hubs, how can they be put to better use?

Any time a property of that magnitude sits vacant, it’s a huge problem for the municipality it sits in. A deserted mall can’t generate tax dollars for its locale just as much as it can’t generate rent for its landlord and revenue for its shareholders. At the same time, the ongoing mortgage debt from a mall that failed can outweigh the value of the property itself. Overall, the prospect of taking on a space of that scale was such a headache, especially with the decline of brick-and-mortar undermining confidence in the investment, that many lenders just elected to let defunct properties just sit unused. So what can be done about these skeletal remains of a bygone era?

Heavy fulfillment

Before the onset of the COVID-19 pandemic, the global supply chain was already fragile, but the burden from the subsequent lockdowns caused it to snap. As businesses tried desperately to keep up with the sudden surge of online orders, a disastrous domino effect ensued. The system couldn’t keep up with demand, causing every point of America’s transportation and logistics operation to buckle. A deluge of shipping containers piled high on cargo ships, overflowing the ports, and straining trucks and rail cars until they wheezed from the hefty weight. It quickly became obvious that the businesses that relied on a localized supply chain could keep their heads well above water while the rest struggled to stay afloat.

The businesses that found themselves in this global scramble tried to recoup their losses by ordering as much additional inventory as they could to safeguard against future slowdowns, but the problem of where to put all of this excess stuff prompted a race for storage space. By November of 2021, 96 percent of existing industrial space was in use, and in order to keep up with demand, the U.S. would need an additional billion square feet of new industrial space by 2025, according to JLL. Demand for new space prompted sky-high bidding wars, ultimately leading enterprises to get creative with converting other types of spaces to suit their storage needs.

Amazon, the online retailer that led the crusade for snatching as much vacant land and development space as possible, spent nearly $60 billion on capital expenditures in order to acquire property and equipment in 2020. Of course, Amazon had already been ballooning in recent years, but they had only spent $24 billion on capital expenditures to expand their real estate the year prior. What’s more, a significant chunk of that $60 billion went to purchasing properties. Amazon is so confident that e-commerce is the imminent reality of retail that they’re planning on operating out of the properties that they’ve purchased for the next 30-50 years minimum, compared to the 10-15 that a lease would allow them to run. But Amazon didn’t limit their spending spree to undeveloped sites, they also procured shopping malls.

The speed and frenzy of Amazon’s real estate acquisitions may make it seem like Amazon was just buying land wherever they could only to solidify a plan for it afterward, but purchasing a shopping mall with the intention of turning it into a warehouse makes logistical sense. Not only do empty shopping malls have an abundance of space, perfect for extra storage as more businesses sign on to sell their products with the e-commerce giant, but malls also have inherent proximity to large population centers.

Shopping malls came into fruition during the 1950s as suburban development sprang to life as a place for suburban residents to shop and socialize, which is how malls became known as the American cultural hub. Amazon knows that the speed at which a package you order from Amazon reaches your doorstep depends on your proximity to a fulfillment center, so buying a property that was intended to be in reach of residential developments is an understandable strategy. Yet while this shift might give the landlord of a mall that’s hemorrhaging money hope, only a small number of these sales and refurbishments have taken place. As of December of 2021, around 50 enclosed regional U.S. malls have been sold during the pandemic, most of them by lenders,” according to the Wall Street Journal, and the “limited number of ‘healthy’ malls sold may reflect unrealistic asking prices.” This is prompting many landlords to hold onto their underperforming properties in hopes that they could get more from the sale of their shopping mall after the pandemic.

Knocking down the existing mall only to build an Amazon warehouse from the ground up is also not an attractive option for landlords of malls that still have a pulse. Despite the rampant closures of retail giants of yore (Sears, JCPenney, Macy’s, etc.), many mall landlords believe that there is a creative solution that could keep the lights on while stimulating shopper activity for the smaller stores that are still operating. If the industrial warehouse sector, which has outpaced other markets over the past two years, can’t inject new life into shopping malls, what can?

Call the doctor

In a trend known as ‘medtail’, a reflection of the medical industry’s shift to retail properties, health care providers are increasingly picking former storefronts for their offices and clinics. Landlords may not have been keen on this in the past for a series of reasons, such as the regulatory burdens or the idea of people sick with a contagious disease congregating on the property. But after a prolonged period of vacancies, landlords are a bit more eager to lease to healthcare tenants with deep pockets.

The medtail shift was a growing trend before COVID-19, but interest in preventative wellness surged as a new infectious disease upended everyday life for people around the globe. While these storefronts aren’t replacing hospitals, medtail can still assist in the provision of economical, specialized, and conveniently accessible facilities for the local residents, and that convenience is a mall’s biggest selling point. “Convenience is essential to consumers… even when they’re choosing a medical office to visit,” says Les Shaver of GlobeSt, “That came to light in a recent survey from JLL, showing that 71 percent of consumers traveled 20 minutes or less to receive care.”

Yet the landlords can go much farther than converting individual stores to a dentist’s office. When the Marketplace Mall in Rochester, New York, had lost its major retailers, the University of Rochester Medical Center came to the rescue. In an undertaking that cost upwards of $227 million and multiple phases, the mall’s empty Sears store is slated to become an outpatient orthopedic center. By November, the ambulatory surgical center will open. The following spring will usher in the Center’s rehab and sports performance center, and by the fall of 2023, the ribbon for the four-story clinic space with 144 beds will be snipped. As of right now, the offices are currently open.

Marketplace Mall is not the first mall to be converted into a medical center, but it does illustrate a surprisingly beneficial symbiosis between the two sectors. The medical center gains a larger and more accessible location, the mall fills a gap that will benefit its other tenants, and, the community gains a facility that is more accessible and connected to where people are. Plus, as more of the Medical Center’s facilities open up, more employees and patients will follow suit, meaning more prospective customers in the active mall that the Medical Center is attached to.

When Misty White Sedell referred to the American shopping mall as a bastion for “discovery” in her piece for that LA Times, she was talking about fashion trends. Now, the shopping mall is a literal incubator for discovery when it comes to real estate. Amazon dedicated itself to deliberately underbidding its physical competitors in order to gain market share, but Amazon dismantling malls in order to build fulfillment centers is not the next phase in the mall life cycle. Shopping malls still have a place in the retail landscape, and things like medical office conversions might be one of the pieces to the puzzle that will reinvigorate them.

Thank you to Propmodo for this article. To read more, click here!

Who’s Afraid of Returning to the Office?

On the night of January 31st in Seattle’s Belltown neighborhood, something shocking happened as an Amazon engineer walked home from work. Video footage revealed that a homeless man had crept up behind her with a baseball bat before taking a full swing at her head. The man, Wantez Tullos, fractured the female engineer’s skull and then simply walked on. Tullos was in handcuffs before long, and police stated that the attack was completely random. Even so, the attacker had a long rap sheet to the point that prosecutors begged a judge to deny him bail. Incidents like this are rare in downtown Seattle and other big U.S. cities, but they’ve been happening more frequently amid a rise in crime.

On the night of January 31st in Seattle’s Belltown neighborhood, something shocking happened as an Amazon engineer walked home from work. Video footage revealed that a homeless man had crept up behind her with a baseball bat before taking a full swing at her head. The man, Wantez Tullos, fractured the female engineer’s skull and then simply walked on. Tullos was in handcuffs before long, and police stated that the attack was completely random. Even so, the attacker had a long rap sheet to the point that prosecutors begged a judge to deny him bail. Incidents like this are rare in downtown Seattle and other big U.S. cities, but they’ve been happening more frequently amid a rise in crime.

“It almost feels like we’re at a tipping point with crime in Seattle right now,” said Lisa Howard, Executive Director for the Alliance for Pioneer Square, a nonprofit neighborhood revitalization org. “The headline-catching violent crimes are isolated incidents. But there’s a need for more mental health services for people on the street in crisis. Also, what we see in the media sticks in our heads.”

Howard is right, random acts of violence like an engineer getting struck with a bat are rare, but they’re also easy fodder for online news sites. As they say, if it bleeds, it leads, and in the online era, bleeding gets clicks and retweets. But the statistics about rising crime in places like Seattle don’t lie, and it’s become a concern for some companies looking to get workers back in the office. Aggravated assaults in Seattle rose by 24 percent in 2021, and violent crime was up 20 percent, according to city police data. There’s a perception of disorder in parts of downtown Seattle that is unnerving office workers, according to Howard.

The city recently cleared out two homeless tent encampments in Seattle’s Pioneer Square neighborhood. Clickbait news cycles often lump crime and homelessness together, but that doesn’t paint an accurate picture. Research doesn’t show a strong correlation between homelessness and crime, and often, homeless people are more likely to be crime victims. But having people out on the street in perpetuity near an office, for example, can make some feel unsafe. Howard said there had been a lot of conversations between downtown Seattle businesses and city officials about addressing public safety. Seattle Mayor Bruce Harrell has ramped up crime-fighting efforts, saying he’ll hire an additional 125 police officers.

More large U.S. cities are dealing with crime increases, rivaling the historic crime levels of the 1980s. President Biden referred to “funding the police” in his recent State of the Union address, and there’s pressure on Democratic mayors and prosecutors after previous calls to “defund the police.” It’s a tricky political topic; getting tough on crime often disproportionally affects poor and minority communities, and the Black Lives Matter protests and riots during the summer of 2020 are still fresh for many people.

For property owners and businesses with offices in downtown areas, the politics of the situation don’t matter as much as having employees feel safe enough to come back to work. Some companies in Seattle are hiring more private security guards and even letting employees leave early, so they don’t have to commute when it’s dark out. Employees are also walking to public transit together in groups. Weyerhauser is a timber company with an office in Seattle’s downtown core and has even delayed its return to the office until April because of street crime concerns. In an email sent to employees last fall, the company’s chief administration officer said they wouldn’t reopen their office until “significant improvements in neighborhood safety,” according to the Seattle Times.

While you may not have heard about crime in Seattle, you’ve likely heard about what’s happening in New York City. New York media is all over the topic, reporting seemingly daily brazen assaults on the subway and rising crime statistics. Criminologists refer to the law of crime concentration, where 50 percent of a city’s crime happens at 5 percent of street segments. So, it doesn’t make sense to talk about crime city-wide because it’s spread out unequally across districts and police precincts.

But Rafael Mangual, Senior Fellow and Head of Research at the Manhattan Institute, a free-market think tank, points out that every major crime category has increased other than homicides in places like Midtown South. Mangual is passionate about the study of criminal justice, his father was an NYPD detective, and he grew up in Brooklyn during the crime wave of the late ‘80s and early ‘90s.

He told me crime in Brooklyn during that era forced his family to move to Long Island. He sounded convinced, as some commentators, that crime is at crisis levels in NYC right now. “There’s crime and disorder, and disorder is important because it impacts peoples’ perceptions of safety,” Mangual said. “When you see things like public drug use and organized retail theft, it communicates that people are brazen enough to do these things, and they feel they won’t get caught. So, people make a psychological calculation. If anything can happen, then I’m vulnerable.” Mangual added this was the basic premise of the ‘broken windows’ theory used by New York City officials to fight crime in the ‘90s. Cops targeted minor crimes like vandalism and loitering to stop visible signs of anti-social behavior that, according to the theory, encourage a cycle of criminality.

There’s a lot of debate about why crime is rising in so many U.S. cities, and what you think often depends on your political leanings. The interesting thing for office occupiers and landlords is that returning to the office can help fight crime. Both Mangual and Howard of Seattle’s Alliance for Pioneer Square acknowledged this. With foot traffic in downtown areas still not at pre-pandemic levels, the streets are emptier, and people don’t feel that same safety in numbers and crowds.

There’s also the economic angle. Without more office workers downtown, there’s less business, more shuttered storefronts, and more of a perception of blight. Mangual is more pessimistic about the state of New York City, noting that while Mayor Eric Adams campaigned on public safety, his efforts may not be enough. Return to office efforts are ramping up again, and now politicians are urging a return to normalcy. But Mangual thinks that if remote workers can work anywhere, why pay higher rents in the city and deal with crime? “Cities are in a much more fragile state than they seem to recognize, given the lack of urgency on the crime issue,” Mangual said.

COVID-19 kept offices largely empty for nearly two years, so is lack of public safety a new concern for corporate occupiers and landlords? It depends. Cities and downtown areas aren’t complete hellscapes, as much as some media outlets paint that picture. The more workers return to the office, the more economic activity will pick up and pump life back into downtown areas. In cities like New York and Seattle, efforts are underway to address rising crime rates and make communities feel safer. Crime may be a concern for some office tenants and employees for now, but it’s not guaranteed it’ll last long. Headline-grabbing random acts of violence in Seattle or in NYC’s subway system may stick in our heads, but the reality is always much more complex.

Thank you to Propmodo for this article. To read more, click here!