HOW TO DO MORE FOR YOUR CREDIT SCORE

Your credit score, also known as your FICO Score, plays an important role when you apply for a mortgage. You can get a free credit report from each of the three credit bureaus once a year at AnnualCreditReport.com. This is the only source for free credit reports, and it’s authorized by federal law. It takes time to build credit for the first time, or to improve your score — there are no quick fixes. But here are some steps the people at FICO say will help improve your score.

Your credit score, also known as your FICO Score, plays an important role when you apply for a mortgage. You can get a free credit report from each of the three credit bureaus once a year at AnnualCreditReport.com. This is the only source for free credit reports, and it’s authorized by federal law. It takes time to build credit for the first time, or to improve your score — there are no quick fixes. But here are some steps the people at FICO say will help improve your score.

Check your credit reports for errors. Get your free credit reports from all three credit reporting agencies and carefully review them for any information that is incorrect or not up to date. When you find an error or information is missing, contact the credit reporting agency that issued the report, as well as the credit card or lender that provided the incorrect information. Checking your own credit report or FICO Score does not impact your score in any way.

Pay your bills on time. This makes up 35% of the FICO Score calculation. Late payments and collections have a significant negative impact on your score. If you’ve missed payments, get current and stay current. The longer your pay on time after being late, the more your score should increase. But if your bill becomes a collection account, it will stay on your credit report for seven years. If you’re having trouble paying bills, contact your creditors, or see a legitimate credit counselor. Seeking such assistance won’t hurt your FICO Score.

Reduce your amount of debt. Making up 30% of the FICO Score calculation is your credit utilization — how much the amount of your debt has used up your available credit. So, keep balances low on credit cards. Pay down your revolving (credit card) debt, rather than moving it around. Pay off the highest interest cards first, while maintaining minimum payments on the others. Avoid closing unused credit cards or opening new cards to increase your available credit — this could lower your credit score.

More tips from FICO. Starting out, it’s advised that you should avoid opening a lot of new accounts too rapidly. This lowers your average account age, impacting your score, and can look risky if you are a new credit user. Open new credit cards only as needed — not just to have a better credit mix, which is unlikely to raise your score. Note that closing an account does not make it go away. It still shows up on your credit report and may be used when calculating your score. Here’s more from FICO about credit scores.

Written by our preferred vendor, Supreme Lending.

NMLS# 1933458

Alpharetta, GA 30022

For Additional Blog Content, Click Here!

To Wait or not to wait? That is the question.

Interest rate increases and financial market uncertainty have caused many to push the pause button on their home purchase journey. Why? Interest rates are still very low, relatively speaking. In the 1980’s rates were three times higher. Believe it or not, people were purchasing homes at the time. Those people are still here and eager to talk about it! The market has been a little shaky this year. I’ll give you that. But, how much does the secondary market really affect the housing market? Let’s zoom out and look at some important factors before jumping to an answer. My research indicates that we are at least six years behind on residential home building in the United States. The phrase “lack of inventory” has become a part of everyday conversation in the residential real estate community across the country. The result has been homes selling for tens and even hundreds of thousands of dollars over list price and upwards of forty purchase offers for sellers to sort through. There aren’t enough homes for the amount of buyers in the market. Meanwhile, rent prices have increased every year. In most real estate markets, it’s actually a smaller monthly cost to pay a mortgage than to rent (pay someone else’s mortgage). Here’s my point: the real estate market is insulated from the secondary market, to some extent, because we are experiencing a nationwide shortage of homes while the demand for homes and cost to rent are increasing. This will be the case for the foreseeable future. So, make peace with yourself about interest rates and please understand that the house you are eyeballing online, the one with the awesome kitchen, will cost you more in a year from now even if the secondary market continues to struggle.

Interest rate increases and financial market uncertainty have caused many to push the pause button on their home purchase journey. Why? Interest rates are still very low, relatively speaking. In the 1980’s rates were three times higher. Believe it or not, people were purchasing homes at the time. Those people are still here and eager to talk about it! The market has been a little shaky this year. I’ll give you that. But, how much does the secondary market really affect the housing market? Let’s zoom out and look at some important factors before jumping to an answer. My research indicates that we are at least six years behind on residential home building in the United States. The phrase “lack of inventory” has become a part of everyday conversation in the residential real estate community across the country. The result has been homes selling for tens and even hundreds of thousands of dollars over list price and upwards of forty purchase offers for sellers to sort through. There aren’t enough homes for the amount of buyers in the market. Meanwhile, rent prices have increased every year. In most real estate markets, it’s actually a smaller monthly cost to pay a mortgage than to rent (pay someone else’s mortgage). Here’s my point: the real estate market is insulated from the secondary market, to some extent, because we are experiencing a nationwide shortage of homes while the demand for homes and cost to rent are increasing. This will be the case for the foreseeable future. So, make peace with yourself about interest rates and please understand that the house you are eyeballing online, the one with the awesome kitchen, will cost you more in a year from now even if the secondary market continues to struggle.GA RMLO: 70948

FL RMLO: LO76819 • CO RMLO: 100530369

TX RMLO: 1410602 •

Twitter Latest Big Tech Firm to Cut Office Space

Twitter announced this week it would close one of its San Francisco offices and shrink its New York City office footprint in a move to save money and embrace more remote work. The company told employees in an email that it will vacate one of its San Francisco offices in a building close to the firm’s headquarters. Plans for an office in nearby Oakland were also shelved. Corporate office space in major markets including New York, Tokyo, Mumbai, New Delhi and Dublin will also be reduced, and Twitter is also considering closing its office in Sydney and other international cities once leases expire.

Twitter announced this week it would close one of its San Francisco offices and shrink its New York City office footprint in a move to save money and embrace more remote work. The company told employees in an email that it will vacate one of its San Francisco offices in a building close to the firm’s headquarters. Plans for an office in nearby Oakland were also shelved. Corporate office space in major markets including New York, Tokyo, Mumbai, New Delhi and Dublin will also be reduced, and Twitter is also considering closing its office in Sydney and other international cities once leases expire.

The news is the latest in a recent trend of major tech companies downsizing their office space or scuttling plans for more space altogether. In June, ratings app Yelp announced it would close some of its U.S. offices, while earlier this month, Facebook parent company Meta pulled back on plans to expand by another 300,000 square feet at its office in Manhattan, and e-commerce giant Amazon pressed pause on the construction of 4 million square feet of office space in Washington and Tennessee. All of the companies cited a need to reconfigure their office footprint in light of the continued preference for hybrid and remote work from employees.

With many companies in agreement that a higher number of hybrid and remote workers will remain steady, office owners have been busy making sure that when employees do come into the office, they’ll want to stay. Landlords are spending big money on amenities to help draw tenants back to the building, offering everything from doggy daycare to rooftop bee colonies. In Chicago, the city’s iconic Willis Tower recently underwent a $500 million renovation and offers a plethora of amenities for building tenants across 150,000 square feet of space. Whether or not it’s the amenities drawing people back to the workplace, things seem to be heading in the right direction, as office occupancy just hit its highest level since March 2020.

Thank you to Propmodo for this article. To read more, click here!

For Additional Blog Content, Click Here!

Why Combining Real Estate Expertise With Financial Planning Is A Winning Combination

Although my articles usually focus on business leadership and entrepreneurship, my experience in corporate America prior to joining the Navy SEAL teams and the master’s degree following my service are all in real estate finance, investment and development. As an entrepreneur and business owner, I also find it prudent to also stay apprised of the best ways to make your money work for you.

Although my articles usually focus on business leadership and entrepreneurship, my experience in corporate America prior to joining the Navy SEAL teams and the master’s degree following my service are all in real estate finance, investment and development. As an entrepreneur and business owner, I also find it prudent to also stay apprised of the best ways to make your money work for you.

It is human nature to want to be right, particularly when it is your job to be the expert. That is one reason why financial planners, individuals who have spent years studying and passing examinations to be allowed to consult people about their wealth, can be quick to minimize the role of real estate assets in a client’s portfolio.

The average CPA receives little to no advanced education about real estate, be that the market or how to manage real estate assets. Perhaps more importantly, such an advisor spends little to no time keeping up with the market or working in that space on a day-to-day basis. Real estate is not something that you can track casually; it is a fast-paced, highly nuanced industry.

That is why a new branch of financial planning called Integrated Asset Management (IAM) is gaining traction. The specialty of this sub sector is expertise across asset classes, to include real estate. But the way that is achieved is not by developing new advisors, it is by putting a variety of experts in the same office.

I recently sat down with Andrew Canter, CEO of Canter Companies and a leader in IAM. In our discussion he said, “No one is saying that financial advisors need to develop a whole new area of expertise; that’s just not realistic. But putting financial advisors and real estate experts under the same roof is, and that is starting to happen.”

At an IAM company, financial planners share an office with the other side of the business, which does real estate investing and development. The outcome is a proximity of experts who operate in two different industries that overlap at important junctures.

The need for a hybrid of expertise is growing. Real estate is an attractive investment right now, with interest rates still lingering near historic lows. In fact, some estimates say there are as many as 30 million Americans who have invested in both commercial and residential real estate. And the Bankrate Financial Security Index Survey released earlier this year suggested that 54 million Americans preferred to put money they would not need for the next ten years into a real estate investment over stocks or bonds.

That means that there is a substantial sector of the market that needs both a financial planner and a real estate consultant to help them manage their assets. Getting two different advisors to agree on how money should be appropriated, which risks to take, and how to achieve the same financial goal is unrealistic. And yet the nuances of managing real estate assets and traditional financial investments demands that anyone with such a diversified portfolio needs both kinds of advisors. At the same time as real estate is factoring into the lives of more and more Americans, fewer Americans know or understand what a financial advisor does. In a survey done this year by advisory firm McAdam, it was found that one in three Americans do not know what a financial advisors does, and that number increases to 46% among millennials. That could in part be because the financial services industry has not modernized itself to meet the needs and priorities of people in today’s economy.

That is, until now. IAM is following the tradition of many industries before it. Consider the movie rental industry. When it began, Blockbuster was king. So much so that one of my core functions as a financial analyst with Trammell Crow Company in, where I worked in 1999 after college prior to joining the Navy, was the analysis of new potential store locations. I remember distinctly because I misspelled their brand name on the cover of the very first proposal I built for them! Not one of my better moments.

But that business model was shaken up in 2002 when Red Box started distributing its DVD vending machines. That model was quickly replaced by Netflix’s DVD mailing business, which was actually able to pivot to today’s video streaming world quite successfully. Each step of the way, the market changed and an old model of business was phased out. Today, the market is arriving at a point where it demands more expertise of its financial advisors.

“This is a very real dilemma for people. I see it all the time,” says Canter. “Integrated Asset Management is a very simple idea: mingle real estate experts together with financial advisors in a mutually beneficial way.”

Whether IAM shakes up the entire financial services industry or just modernizes a piece of it, its emergence is an indicator of an industry in transition, which is good for all of us.

Thank you to www.forbes.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

Experience Matters: Estate Planning and Real Estate

Why is it important for you as an attorney, estate planner, trust administrator, or SNT trustee to have a go-to real estate professional assisting you with your client’s real estate needs?

Why is it important for you as an attorney, estate planner, trust administrator, or SNT trustee to have a go-to real estate professional assisting you with your client’s real estate needs?

Because having the right real estate professionals representing your firm matters when it comes to helping you build or maintain your client’s legacies through the acquiring of real estate assets as well as selling those assets to pass those legacies on, when and if that time comes.

We believe you should be able to be proud of the real estate firm representing you and thankful to be associated with them. The right real estate group should make you look good to your clients.

And here’s why we believe The Meridian Real Estate Group with its wide array of real estate services and specific experience in estate planning related transactions should be your go-to real estate professionals.

Commercial and Residential: The Meridian Real Estate Group has both a commercial and residential division including land and luxury. We are a one-stop shop and can handle any type of real estate needs your clients may have.

Service: We pride ourselves with going above and beyond for our clients and providing them with excellence in everything we do. It’s not enough for us to be a full-service real estate group, we also strive to provide superior service to all of our clients.

Land: Buying and selling land can be a daunting task and should be handled by professionals. Thankfully, with tens of millions of dollars of land transactions under our belt, we are not only considered experts in the field but are also widely sought-after specialists.

Luxury: Having worked with successful business executives and owners, as well as entrepreneurs, professional athletes, and celebrities, we are very accustomed to working with high-net-worth individuals and their assets, and fully understand the discretion and professional decorum needed to make them and their families feel comfortable.

Preferred Vendors: Our team of preferred vendors including appraisers, handymen, plumbers, electricians, roofers, landscapers, painters, junk removers, etc., are ready to help us get a property ready for market at a moment’s notice. Having these professionals available and on the ready is a huge benefit and often underappreciated until the time comes that one is needed.

Experience: With years of diverse real estate experience including collaborating with estate planners, trusts administrators, 1031 exchange intermediaries, and SNT trustees, we believe our team would be a great asset to your firm and would love the opportunity to earn your business and make you look great to your clients.

For Additional Blog Content, Click Here!

Rent spiked again in April, expected to keep climbing through the year

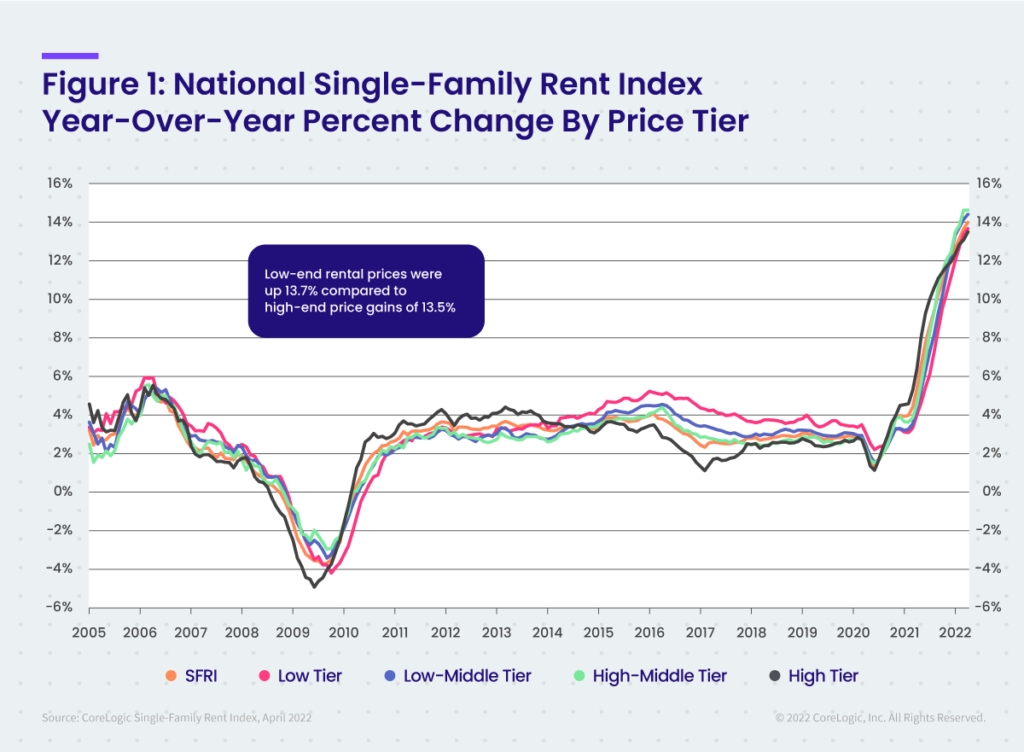

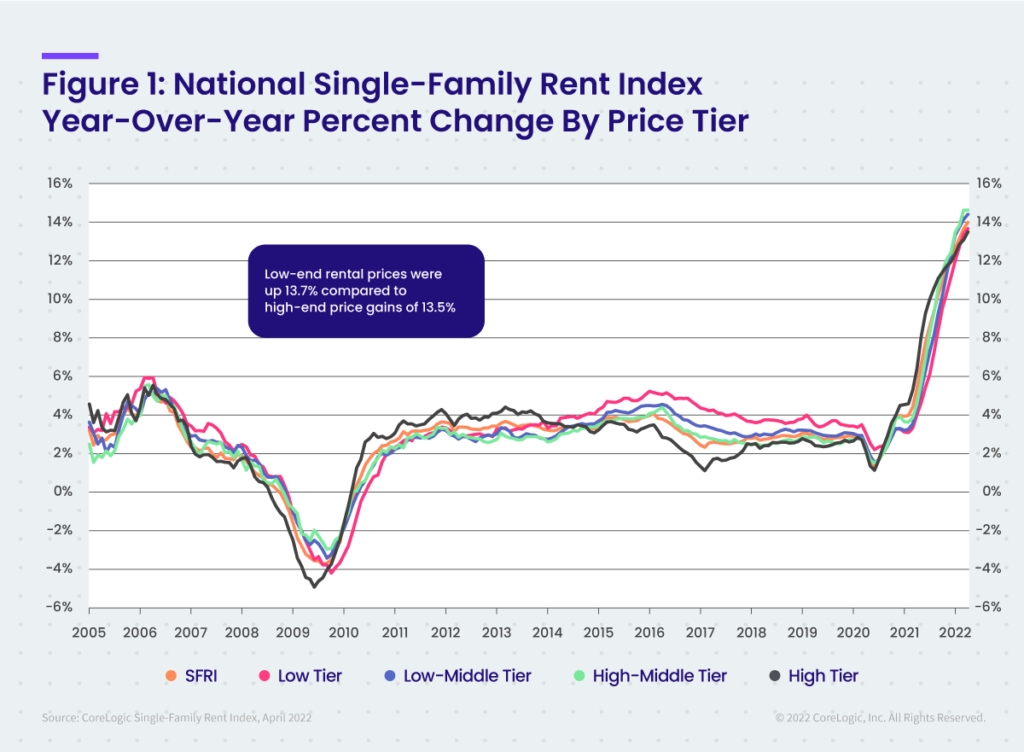

The pace of rent price growth was more than double what it was a year ago, reaching 14 percent for a single-family home in April, according to a report released Tuesday by CoreLogic.

The pace of rent price growth was more than double what it was a year ago, reaching 14 percent for a single-family home in April, according to a report released Tuesday by CoreLogic.

In a shifting real estate market, the guidance and expertise that Inman imparts are never more valuable. Whether at our events, or with our daily news coverage and how-to journalism, we’re here to help you build your business, adopt the right tools — and make money. Join us in person in Las Vegas at Connect, and utilize your Select subscription for all the information you need to make the right decisions. When the waters get choppy, trust Inman to help you navigate.

The price of rent continues to climb at a record pace, with single-family homes renting for 14 percent more this year than a year ago.

And if that’s not bad news for a growing pool of renters, many of whom have already been priced out of the buyer’s market, it gets worse.

“We expect single-family rent growth to continue to increase at a rapid pace throughout 2022,” said Molly Boesel, principal economist at CoreLogic, a real estate data company that tracks home price growth.

The cost of a single-family rental was 14 percent higher than a year ago in April, a report released Tuesday by CoreLogic said. That’s more than double the rate of growth from April 2021, and six times higher than April 2020. It was the 13th consecutive month of record-breaking annual price gains.

The sustained and rapid growth is due to a shortage of rental properties in the market and a thriving job market, the report said.

“Single-family rents continue to increase at record-level rates,” Boesel said. “In April, rent growth provided upward pressure on inflation, which rose at rates not seen in nearly 40 years.

Miami continued its break-neck pace of rent growth, with single-family rentals going for 40.8 percent more in April 2022 than a year ago. (In April 2021, rent grew at an annual rate of 5.6 percent.)

Orlando, Florida and Phoenix followed Miami with the second- and third-highest price growth. Rent grew 25.8 percent in Orlando and 17.8 percent in Phoenix.

Rent grew slowest in Honolulu (7.7 percent) and Philadelphia (7.8 percent), according to the report.

“Phoenix’s April 2.7% unemployment rate is likely helping drive demand and rental cost gains,” the report said, “while Philadelphia’s 6.2% unemployment rate could be causing more tenants to stay put to avoid incurring additional expenses.”

CoreLogic says the growth of multi-family rentals has been more moderate than single-family because of a rush of demand for the latter, created by the COVID-19 pandemic. The gap is starting to close.

The sources of rental income properties, foreclosed homes, all but dried up in that same time, and forecasters don’t expect there to be a backlog of distressed properties that will come on the market any time soon.

April 2022 single-family rental price chances

- Lower-priced (75 percent or less than the regional median): 13.7 percent, up from 4 percent in April 2021

- Lower-middle priced (75 percent to 100 percent of the regional median): 14.4 percent, up from 4.4 percent in April 2021

- Higher-middle priced (100 percent to 125 percent of the regional median): 14.6 percent, up from 4.6 percent in April 2021

- Higher-priced (125 percent or more than the regional median): 13.5 percent, up from 6.4 percent in April 2021

Thank you to Inman.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

US existing-home sales prices tally new record after topping $400K

Sales of existing homes fell for the fourth-straight month in May, according to data released Tuesday by the National Association of Realtors.

Total sales of existing homes, condos, and co-ops dropped 3.4 percent between April and May nationwide to a seasonally adjusted rate of 5.4 million in May. Sales were down 8.6 percent year over year from their rate of 5.92 million in May 2021.

The decline is the latest sign that the once red-hot housing market has cooled as mortgage rates and record high prices push more buyers out of the market. The median home sale price clocked in at $407,000, marking the first time median prices exceeded $400,000. The median price of an existing home increased 14.8 percent from the previous year, when prices hovered around $355,000, marking 123 consecutive months of price increases.

May’s numbers may represent an end to the pandemic housing market, said NAR experts, which saw elevated competition and a migration of buyers from city centers to outlying suburbs.

“Home sales have essentially returned to the levels seen in 2019 – prior to the pandemic – after two years of gangbuster performance,” NAR Chief Economist Lawrence Yun said in a statement. “Also, the market movements of single-family and condominium sales are nearly equal, possibly implying that the preference towards suburban living over city life that had been present over the past two years is fading with a return to pre-pandemic conditions.”

While sales are down and will likely continue to go down, home price appreciation will likely continue unabated without any significant increase in supply, Yun predicted.

“Further sales declines should be expected in the upcoming months given housing affordability challenges from the sharp rise in mortgage rates this year,” Yun said. “Nonetheless, homes priced appropriately are selling quickly and inventory levels still need to rise substantially – almost doubling – to cool home price appreciation and provide more options for home buyers.”

Homes stayed on the market for 16 days in May, down just one day from April and March when typically stayed on the market for 16 days according to the NAR.

All cash buyers made up about 25 percent of all transactions in May, down one percent from April but up two percent from May 2021.

16 percent of homes were purchased by individual investors or second-home buyers, who typically purchase in all cash, according to the data.

Less than 1 percent of sales were made up of distressed sales — foreclosures and short sales.

Thank you to Inman.com for this article. To read more, click here!

IGNORE THE MEDIA — THE HOUSING MARKET ISN’T CRASHING

It seems like every day I’m reading fearful articles about a looming housing crisis.

It seems like every day I’m reading fearful articles about a looming housing crisis.

Forbes wrote: “Pending Home Sales Plunge to Lowest Level in Nearly a Decade.”

Seeking Alpha posted: “The Air Is Coming Out of the Housing Bubble.”

Fortune warned: “The Cooling Housing Market Enters Into the Great Deceleration.”

Many Americans are looking for answers. Google searches for “housing crash” have surged in recent years.

(Source: Google Trends.)

Although I don’t see a housing crisis on the horizon, I can understand the fear.

When looking at the median net worth of Americans, home equity accounts for 65% of that wealth.

Couple that with what happened in the 2007-2008 crash, and it’s easy to see why many are concerned.

Despite these fears, we’re still looking at higher prices for the foreseeable future.

And the latest data shows why that’s the case.

HOMEBUILDERS GOT A WAKE-UP CALL

For some, U.S. home prices appear to be on the verge of cracking.

After new and existing home sales both reached a 14-year high in 2020, sales have been trending back to normal levels.

Considering rising mortgage rates and housing prices, this was expected.

But homebuilders got a wake-up call last month. New home sales fell 16.6% between March and April.

This was a huge surprise for economists, who only expected a 2% drop.

The slowdown in sales has created the largest inventory of new homes since 2010. It would take nine months to sell out inventory at last month’s sales pace.

Although this warrants some concern, the inventory problem isn’t nearly as bad as it seems.

THE STAGE IS SET FOR HIGHER HOME PRICES

New home inventory doesn’t tell the whole story. You also have to look at existing home inventory.

U.S. existing home inventory has been trending lower for several years. At its current level, it would take just over two months to sell out inventory.

I expect low levels of existing home inventory to continue into the foreseeable future.

With mortgage rates nearly doubling since early 2021, existing homeowners are likely satisfied to remain in their current homes.

This should continue to keep supply in check.

(Sources: National Association of Realtors, Bankrate.)

And what about demand?

Even though the media talks about declines in home sales, the big picture isn’t too concerning.

Existing home sales are still above their 10-year average.

(Source: Bloomberg.)

Future demand should remain strong thanks to rising rents.

According to Realtor.com, the median rent for a two-bedroom apartment has risen 45% over the past two years.

Although this only accounts for the top 50 metro areas in the U.S., it serves as a good barometer for the state of the national rental market.

I expect rising rents will drive demand from first-time homebuyers who are currently renting and have cash on the sideline.

Couple this demand with the tight supply we’re still seeing in existing homes, and the stage is set for higher prices.

But keep in mind the rapid growth we’ve seen since 2020 is an anomaly.

I wouldn’t bank on growth of that magnitude to continue.

By, Steve Fernandez

Thank you to banyanhill.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

Real Estate and Your Estate Plan: How Does It Work?

It’s a subject most people don’t like to talk, read, or even think about. But it’s a necessity to be dealt with: What happens to your home when you die?

It’s a subject most people don’t like to talk, read, or even think about. But it’s a necessity to be dealt with: What happens to your home when you die?

When you pass away or become incapacitated, managing your final wishes can be devastatingly emotional and messy for your loved ones. So it’s important to sit down and make key decisions about a lot of things. High on the list: how to pass down your assets—mainly property—to your heirs.

To explore the ins and outs of incorporating real estate into your estate plan, we talked to Lucy Marsh, professor of law at the University of Denver in Denver, CO. Marsh specializes in property law and estates and trusts, so if you heed her advice, you can rest easy knowing your affairs are in order.

Q: Do you really need to make a will to pass down real estate?

No, but it’s a good idea. The intestate statute will automatically pass your land, and your other assets, to your closest relatives, in accordance with the laws in your state. But if you want the land to stay together or go to a particular person then, yes, you need to write a will.

Or let’s say, for various reasons, you don’t want your heirs to inherit your property or other assets. Without a will, you can’t allocate where you do want the property to go in lieu of not-so-favored relations, and that’s where things get messy. If you don’t have any kids (and don’t plan to), you can choose nieces, nephews, siblings, or even charities as beneficiaries, but make sure you provide primary and backup names and spell out that certain individuals shouldn’t profit from your estate.

Q: What happens when a homeowner doesn’t have a will?

Without a will, the person’s estate is considered intestate and goes into probate, which is the legal proceeding by which someone’s assets are sorted out by the courts.

The land, and everything else the person owns, will be distributed according to the intestate statute in the state where the person was living when he or she died. It typically takes up to a year (or more) for a probate case to work its way through the system and can get expensive since you almost always need to hire an estate attorney. Probate does have the benefit of cutting off creditors’ claims by the end of the process.

Q: How is a home, whether it’s a primary or vacation property, tackled in a will?

The first question to ask: Is it designated as a joint tenancy or tenancy in common? In a joint tenancy, two people co-own the property in equal shares. So if one person dies, the ownership of the property automatically gets transferred to the surviving owner without a will. This is considered right of survivorship. All you have to do is record a copy of the death certificate for the deceased joint tenant.

Common tenancy means that two or more people can own a property in varying parts. Unlike joint tenancy where ownership must be assumed in equal shares at the same time, common tenancy can occur at different times where owners are added (or removed) from the property’s ownership. Tenants in common, unlike joint tenants, have no rights of survivorship unless the deceased’s will specifies that his or her interest in the property is to be divided among the surviving owners. Otherwise, the owner’s share of the property belongs to his or her estate, and a will directs where that share goes.

Q: What happens after an heir inherits the property?

The person who inherits the land takes it, subject to whatever mortgage exists. That person needs to make a will immediately, if they don’t have one already, to make it clear what should happen to the property in the event of his or her own death. The heir can choose to keep or sell the property.

Q: Can you allocate portions of your property to go to different people?

The short answer is yes. Property can be split up any way you want; you can give one heir a larger percentage than another heir if you wish. If you have considerable real property assets, you might decide you want one house to go to one child and another to go to your second child. You can split up land into tracts, too. It’s always a good idea to name contingency heirs in the event that your heirs die before you do (and before you have a chance to update your will).

Q: If both spouses die at the same time, what happens to their property?

If two people own land and die at the same time, uniform probate code states that each half of their ownership would go into their own estate. And that means each person could designate their own heirs or beneficiaries to inherit their half of the property.

Q: How does a trust work and how does real estate factor into it?

For starters, a trust is not a will; a final will comes into play after you die and it states your final wishes. On the other hand, a trust is a legal document that essentially puts your assets into a box and asks someone to manage it while you’re still alive but incapacitated. You select a trustee and a back-up trustee in case your first choice is unable (or unwilling) to act on your behalf.

There are two types of trusts: a testamentary trust, which is included in your will, and a living trust, which is created while you’re alive. Both types of trusts can include land.

A living trust, which is another way to keep your assets out of probate, can be either revocable or irrevocable. Once assets are placed in an irrevocable trust, the property no longer belongs to the homeowner/grantor but rather the trust. Just like renting a house or leasing a car, the assets are still there for your benefit, and a trust can sell the house and buy another. The great disadvantage, though, is you can’t change your mind and you’re stuck with your original decisions.

An irrevocable trust can provide the best possible protection of assets from claims by creditors, as the assets have literally changed ownership from the grantor to the trust. This is very different from a revocable trust situation where the grantor retains complete ownership of the property until his or her death. The major practical issue with a living trust is you might forget to put assets into it, which subjects those forgotten assets to probate.

It’s smart to put your wishes in writing so your children or other beneficiaries are not left trying to sort everything out while they’re grieving, too. A lack of a will or unclear directions can complicate relationships and cost thousands of dollars in attorneys’ fees. Have a frank discussion about your estate plans with people who should be in the know, and you’ll (hopefully) avoid confusion and bitter squabbles down the road.

Thank you to Realtor.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

ESTATE PLANNING FOR REAL ESTATE

Almost all estate planning clients own real estate in one form or another – a residence, a vacation home, or a rental properties. Real estate presents unique challenges in estate planning because debt is often associated with the property and because it may be difficult (or not desirable) to sell the property.

Almost all estate planning clients own real estate in one form or another – a residence, a vacation home, or a rental properties. Real estate presents unique challenges in estate planning because debt is often associated with the property and because it may be difficult (or not desirable) to sell the property.

Primary Residence

The most common property ownership is a client’s residence. A residence is often sold as part of the administration of an estate and the net sale proceeds are then distributed as part of the residue of the estate. Your residence, however, may be given to a particular beneficiary and if that is your desire your Last Will and Testament should clearly provide for his disposition. If there is a mortgage, you can condition the beneficiary’s receipt of the residence on the assumption of the mortgage or provide in your Last Will and Testament for the pay off of the mortgage.

Clients sometimes will jointly or solely title real estate with a child to “avoid probate”. Although titling the property this way may simplify or avoid an estate settlement, the sale of the property likely will have adverse income tax consequences. Most homeowners take for granted that a primary residence can be sold without the recognition of a capital gain provided the capital gain is less than $250,000 for one resident or $500,000 for joint residents. This exclusion, however, only applies to a property that is a primary residence of the seller for two of the last five years. For example, if you purchased your house for $100,000 and sell it for $300,000, then the $200,000 capital gain does not result in any capital gains tax. However, if the residence was gifted to a child during the parent’s lifetime, the child will not satisfy this rule if the child’s primary residence is elsewhere. The tax due would be $47,600 (20% for the capital gain and 3.8% for the net investment income tax, if it applies).

Vacation Properties

Vacation properties present special planning challenges. There is often a desire to keep a vacation property within a family but this may not be practical. Joint ownership among heirs can create a variety of issues. How are the costs of ownership to be divided? What happens if an owner fails to contribute his or her share of the costs? How is the use of the property determined? Should the property be rented to third parties? What happens if an owners wants out of the arrangement? What if an owner goes through a divorce or bankruptcy? It is important that a client has realistic expectations. Although a trust can own a vacation property instead of individual heirs, these issues must still be addressed and ultimately resolved by a trustee.

One advantage of a vacation property is that a property located outside of Pennsylvania generally can avoid a state level inheritance tax or estate tax upon the death of an owner. Pennsylvania taxes all transfers of property at death (transfers to spouses are taxed at 0% and transfers to children are taxed at 4.5%) with no amount of property transferred being exempt. Pennsylvania’s inheritance tax, however, does not apply to property located in another state. New Jersey does not tax transfers at death to children. Delaware has a tax but provides for an exemption of over $5,000,000. Therefore, ownership of real estate in these jurisdictions is a way to avoid Pennsylvania inheritance tax.

Investment Properties

A client with investment properties (whether residential, commercial, or industrial) has a variety of issues to consider in his or her estate plan. These issues generally consist of (1) planning for payment of estate tax and inheritance tax, (2) planning for the transfer of ownership of the investment, and (3) dealing with debt.

As with a family-owned business, real estate presents the problem of being valuable but not liquid. A client with a significant portfolio of investment properties will need to plan carefully to create liquidity in the estate in order to pay the inheritance tax and the estate tax, if applicable. Many clients will address this issue through the ownership of life insurance. Life insurance is not subject to the Pennsylvania inheritance tax and life insurance ownership can be structured so the death benefit is not subject to federal estate tax (generally speaking, the life insurance is owned by an Irrevocable Trust). If there is sufficient equity in the properties, then consideration can be given to borrowing against the equity.

A client will need to give consideration to how a real estate investment will be disposed of at death. There is sometimes a desire to continue ownership for the benefit of a surviving spouse so the surviving spouse can continue to benefit from the cash flow of the investments. If there is bank debt, however, the transfer to a surviving spouse or to a trust for the surviving spouse’s benefit often will require the consent of the lender. If the investment is owned with other investors, then any agreement governing the transfer of ownership (a “buy-sell” agreement) must allow for such a transfer.

Often, the buy-sell agreement requires the sale of the investment in the event of death. Careful attention needs to be given to the terms of a required sale. Is a down-payment required? Is seller-financing required? If there is seller financing, then is the debt secured or unsecured? How long is the financing term and how frequently will payments be made (monthly, yearly, etc.)? What happens if the other investors cash out of the investment (that is, will the surviving spouse be paid in full if there is such an event)?

Another key consideration with buy-sell agreements or retaining the real estate investment in-kind is the payment of death taxes. Generally speaking, if there is a transfer to a surviving spouse (or in trust for the surviving spouse’s benefit) there is no federal estate tax or Pennsylvania inheritance tax due. If taxable heirs (children) are to receive the real estate investment in-kind or are to receive installment payments under a buy-sell agreement, then your estate’s liquidity must be analyzed to ensure that the death taxes can be paid at that time. For example, if the real estate or buy-sell payments have a $2,000,000 value, this value could trigger $90,000 of inheritance tax and $800,000 of federal estate tax. From the buyer’s perspective, will there be sufficient cash flow to meet the payment obligations? For example, cash flow from a residential development project may be years away or unpredictable.

Conclusion

Real estate is and will continue to be a valuable asset for most clients. Residential real estate, vacation properties, and investment real estate all provide clients with potential for capital appreciation and, in the case of rented vacation properties and investment properties, the potential for income. Clients should give considerable thought to the disposition of these assets in the event of death to make sure that taxes are minimized and the client’s intent is carried out.

Thank you to www.mcneeslaw.com for this article. To read more, click here!

For Additional Blog Content, Click Here!

What Is the New Corner Office?

Changing our offices means changing the ways that we perceive success in an organization. Having an office, a permanent place to put your things or be alone, is a universal signal of value. It is an acknowledgment of commitment from employer to employee. It tells them that they belong, that they deserve a place. We even have a hierarchy for offices, particularly when it comes to the kind of people that are allowed to use them. The pinnacle of which is the corner office. “Corner office” has even become slang of its own, akin to “C-Suite” and “Higher-Ups.”

Changing our offices means changing the ways that we perceive success in an organization. Having an office, a permanent place to put your things or be alone, is a universal signal of value. It is an acknowledgment of commitment from employer to employee. It tells them that they belong, that they deserve a place. We even have a hierarchy for offices, particularly when it comes to the kind of people that are allowed to use them. The pinnacle of which is the corner office. “Corner office” has even become slang of its own, akin to “C-Suite” and “Higher-Ups.”

If we want to take that affirmation away from people, if we have to get rid of corner offices, we need to find out what else it can be replaced with. We have to think about what not aspiring to be the one in the office means for the way that achievement and belonging are perceived in the organization. That means that the first step in the path toward rethinking a workplace starts with introspection. “Before you decide what your office will be you first have to understand the corporate culture,” said Mahesh Vidyasagar, Head of Real Estate at Robert Half, a staffing and recruiting firm.

Vidyasagar has spent his career in real estate and he accepts the emotional connection people have with it. “Real estate is personal, if you mess with it there are always tensions,” he told me. When he was brought in to help Robert Hall rethink their office footprint he started by first understanding the organization. Soon he came to realize that they had the type of flat hierarchy and open culture that would lend itself well to flexible work. Then he started to ask what the employees thought about having a flexible office and, of course, losing the corner offices.

“What I learned was that for many, flexibility is the new corner office,” he said. Now he believes what makes people feel valued and trusted is allowing them to choose their own schedules. Losing a personal office isn’t so impactful when it allows people to use an office when and how they want. Allowing for flexible work arrangements shows a type of trust that is hard to replicate, even with a dedicated office.

What works for some organizations might not work for others. The personal impacts of a change to a workplace vary greatly from person to person and team to team. But, using a bit of empathy to understand people’s jobs goes a long way, according to Vidyasagar. As head of Corporate Real Estate for Comcast’s West Division, he was faced with the hard decision of whether or not to invest in standing desks in their call centers. “They were so expensive at the time and we didn’t know if it was worth it,” he said.

After spending time in a call center, seeing what they did every day, and talking to them about their job he realized that the work was very hard and often seen as unhealthy both mentally and physically. So, his team decided to make the investment in the standing desk, despite the costs. “We instantly saw benefits, both in morale and in productivity,” Vidyasagar said. Besides the obvious health benefits of not being forced to sit all day at a desk, employees appreciated the thought that went into the investment as well, “they just liked knowing that we cared about them enough to invest in them.”

The connection between employee happiness and productivity is well studied in academia. But as much as many office and facilities managers would like to use employee morale and employee output as metrics for office success, the subjective nature of both of the concepts makes it nearly impossible. The metric for success that Vidyasagar likes to use instead was a bit surprising to me, both for its freshness and its simplicity. He boiled down the office’s impact on an organization into market share per square foot. He thinks that only by comparing an office footprint to the overall strength of a company can you really understand the intrinsic value of an effective workplace.

Rather than merely thinking about office density or trying to peg it to something as subjective as productivity, Vidyasagar thinks that the office should be seen for its entire benefit to the company. Sometimes those benefits, like morale, creativity, and culture are hard to fully measure. But what can be easily understood is how the company is performing against its competitors. If the organization is able to increase its market share without the need for more office space, that equals an improvement.

When employees are no longer tied to the office, their work shouldn’t be either. As organizations look to overhaul their workplaces they also need to answer an important question, “In the modern office, how can we give employees what makes them feel valued?” Only by learning this can they really create a space that helps boost an organization. Companies that ask that question might be surprised by what they find. Priorities have shifted and based on the new way that people are thinking about their work life, it might be that flexibility is actually the new corner offices.

Thank you to Propmodo for this article. To read more, click here!

For Additional Blog Content, Click Here!

Why Combining the Physical and Virtual Office Makes Better Salespeople

With the pandemic showing signs of winding down and a potential return to normalcy on the horizon, the decision of whether or not to “return to the office” is at the forefront of everyone’s mind.

With the pandemic showing signs of winding down and a potential return to normalcy on the horizon, the decision of whether or not to “return to the office” is at the forefront of everyone’s mind.

Unsurprisingly, the verdict of that decision varies depending on who you ask. A recent study found that 75 percent of executives currently working from home say they want to work from the office three to five days per week, compared to only 34 percent of employees. Clearly, there are some differences of opinion on the importance of returning to an office environment.

While a return to the office may not be necessary (or desired) for all employees, the office is a good thing for salespeople. Here’s why.

Friendly competition never hurt

As early as September 2020, companies like JPMorgan Chase were already beginning to ask some of their sales staff to return to the office. While there are various reasons salespeople have been the first to be brought back into the office, most of them boil down to this: salespeople need competition.

Competition, both amongst external competitors and internal peers, is frequently cited as one of the primary motivations for salespeople. Whether it be trying to make one more call than your desk neighbor or being the highest earner on your team next quarter, this type of friendly competition is difficult to foster in a virtual environment. There is a significant difference between competing against your peers as you all sit at home alone versus doing the same next to each other in an office. Many salespeople discovered this first-hand over the last two years.

The competitive environment fostered in an office is also helpful for training and motivating new salespeople. New team members can see first-hand how senior team members conduct themselves, and the value of overheard conversations, body language, and impromptu lessons cannot be understated. Working alongside the team’s top sellers also acts as a great motivational tool for new salespeople, giving them common goals to aspire to and confirming that success is attainable. Seeing is believing in the sales world, and being in an office is what makes that possible.

Art Markman, professor of psychology and marketing at the University of Texas at Austin, agrees that working alongside others in an office environment can lead to “goal contagion.”

“When you observe the actions of other people, you often adopt their same goals,” said Markman. “Being around a group of people who are working toward a common mission reinforces that goal in everyone in the workplace.”

For employers considering a return to the office for their sales team, highlighting the benefits of this competitive environment could be an excellent way to encourage them to return (if they haven’t done so on their own already). Implementing new sales competition ideas, such as prizes, bonuses for hitting certain milestones, or a leader board posted in the break room, and promoting an atmosphere of friendly competition at the office could also help sales managers motivate their teams and encourage a return to in-person work.

Work environment matters

If competition is the primary motivator for most salespeople, a sense of camaraderie is the second. Salespeople are frequently team players and thrive in environments where they feel connected to their teammates. Considering a recent study conducted by the Pew Research Center found that 60 percent of employees felt less connected to their coworkers when working from home, it’s no wonder so many salespeople have been itching to get back into the office.

A physical office is the best work environment for most salespeople because it offers them a dedicated space to form bonds with their coworkers in a professional setting. Sure, a sales team could work virtually from home and promise to meet up for a happy hour once a quarter, but it’s hard to replace the day-to-day interactions that an office provides. From the stereotypical “water cooler” conversations to the high fives after a successful call with a client, the office environment offers the little touch of teamwork and connection that salespeople are after.

Plus, think about it this way, if you had the opportunity to close a massive sale, would you prefer to do it at home alone or in an office surrounded by your team? Lone-wolf sellers might do financially well for themselves, but the sales team’s performance and morale make a company thrive.

The other benefit of a physical work environment is the legitimacy it brings to a company, both in the eyes of its employees and its customers. Whether an employee wishes to return to the office full-time or not, knowing that a physical office exists and is available to them if they need to hold meetings, take important calls or grab the occasional free snack is reassuring and convenient. From a client perspective, being brought into the office to meet with the sales team face-to-face is a traditional (and still often expected) part of the sales process. While taking video calls from a home office is undoubtedly more convenient, there’s still something to be said about meeting in person.

Sure, office space can be expensive for an employer, but the benefits of the office’s work environment to sales teams are well worth the cost.

Virtual tools improve the customer experience

Although the past two years have been a struggle for many salespeople, the technological innovations related to remote work can help give sales teams the competitive edge they need.

Zoom, the videoconferencing platform many of us were using (even before the pandemic), has led the charge in this regard. Zoom’s recent Work Transformation Summit touched on a number of topics related to how work and the sales process have changed due to the widespread adoption of virtual tools in the professional world. In the summit’s keynote, Oded Gal, Zoom’s Chief Product Officer, took the time to point out that even customers themselves have changed.

“Customers have changed the way they consume. They expect instant access to 24/7 support and have grown increasingly frustrated with wait times,” Gal said. “Customers want to feel valued and want a business relationship that feels less transactional and more like a partnership. If your company does not offer them the experience they desire, they will go elsewhere.”

To make this partnership experience a reality, sales teams can draw on virtual tools to streamline their sales process and offer more transparency to their clients. Rather than the occasional in-office visit or bi-weekly phone call, salespeople can now regularly check in with their clients via video calls, collect feedback through online customer portals and help solve and reduce complaints with advanced customer support options. Better yet, an in-office sales team may even be able to close more sales at a lower overall cost by cutting back on the travel and meals that would have been required had these virtual tools not been available.

Combining the benefits of an in-office environment with virtual tools to improve the customer experience will be critical for sales teams if they wish to remain competitive in the post-pandemic world moving forward. Offices make better salespeople, and adopting virtual tools can only make them better.

Thank you to Propmodo for this article. To read more, click here!

For Additional Blog Content, Click Here!